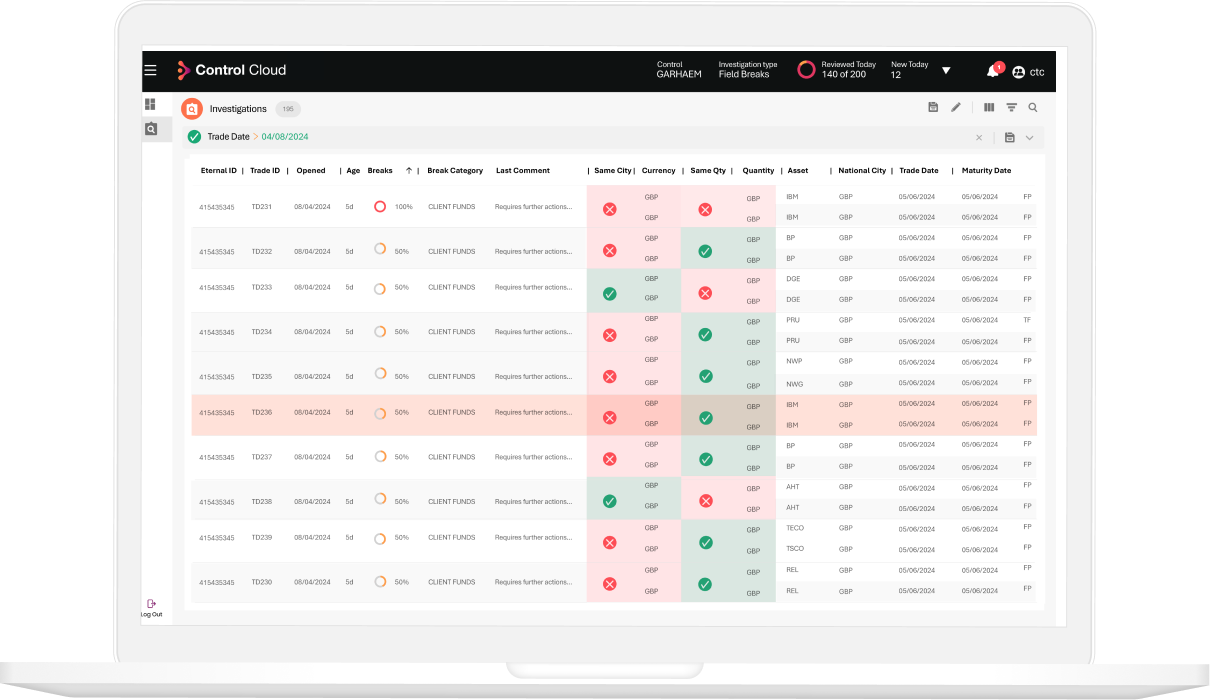

Reconciliation software automates the comparison of financial data across different systems to identify discrepancies and exceptions. It eliminates the need for manual, spreadsheet-based reconciliation that traditionally consumed significant back-office time.

The software pulls data from trading systems, banks, custodians, and other sources, then applies business rules to match transactions and flag misalignments. Advanced platforms can handle real-time data feeds from unlimited sources, process millions of records daily, and use intelligent matching algorithms that work even with poor data quality.

Core functionality includes automatically gathering data, matching transactions using algorithms, and managing exception workflows. Modern platforms also learn from user decisions to improve accuracy over time while reducing false alarms.

For financial firms, reconciliation software is essential for risk management and regulatory compliance, ensuring that positions and obligations accurately reflect reality across all counterparties and systems.

-1.png)