Control Cloud

Securities

Automate, validate and reconcile your transaction data,

workflows and reporting.

Time savings to onboard new transaction controls at a leading global clearer

Front office systems integrated with Control at a tier one bank

Reduction in daily break count at a tier one bank which switched from a legacy platform to Control

product overview

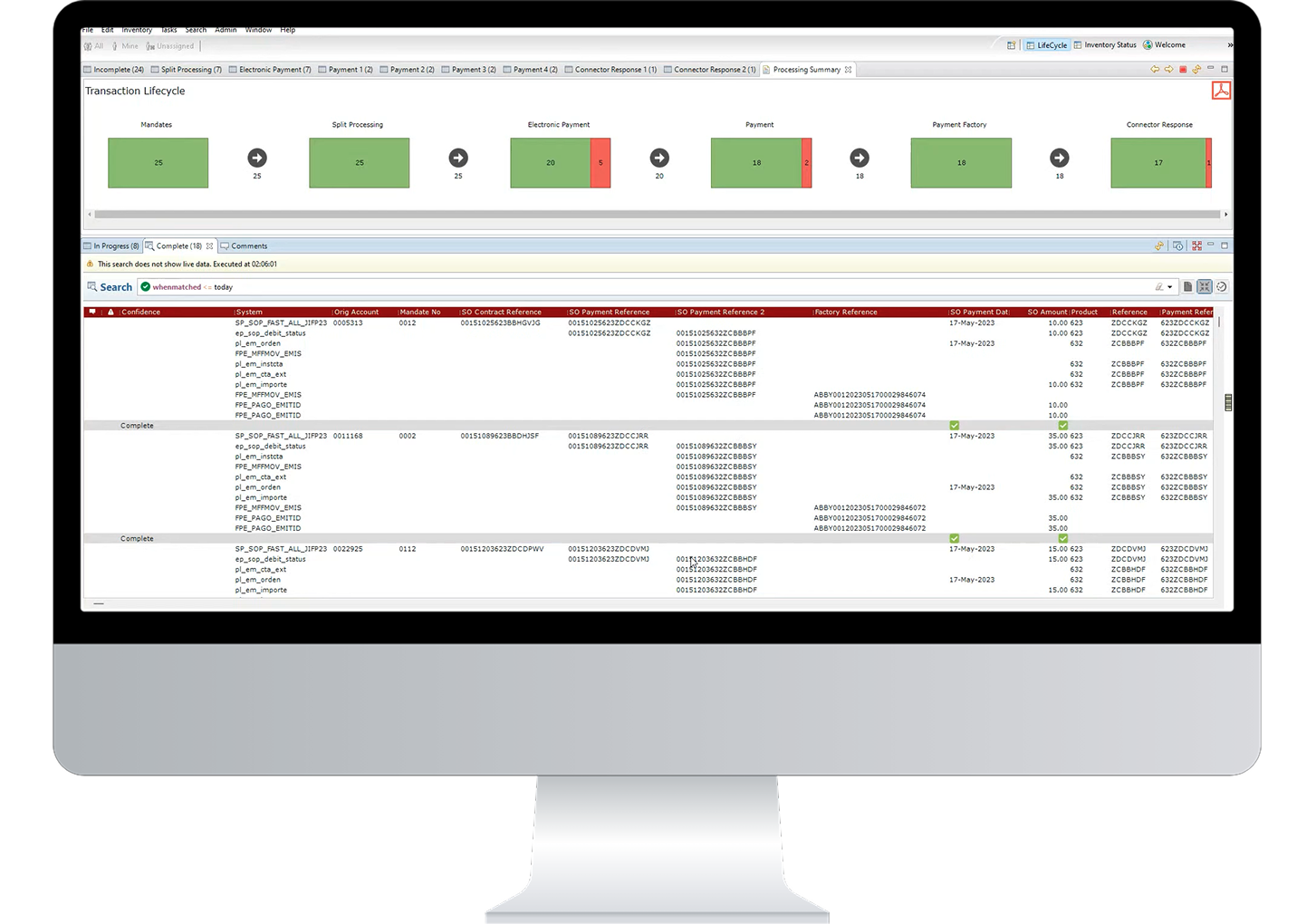

Control your transactions and optimise your operations

Automate Securities Reconciliation

Manage increasing trading volumes and complex regulations with an automated reconciliation solution. Ensure timely and accurate settlement of securities transactions, even as custodian relationships and data complexities grow. This system helps mitigate operational risks and maintains control over your reconciliations with efficiency and reliability.

Reduce Trading Risks

Leverage a solution built with leading banking partners to streamline and enhance your securities reconciliations. Automate processes to minimise manual errors, improve data accuracy, and achieve swift compliance. Enjoy a user-friendly interface that allows for easy updates and reduces IT involvement, ensuring effective and flexible reconciliation management.

Reconciliation, made simple

Optimised Securities Operations Management

-

Comprehensive Securities ControlManage your entire securities operation seamlessly with an integrated solution that covers every stage from trade capture to settlement. This end-to-end system ensures accuracy, reduces operational complexity, and enhances efficiency, giving you full control over your securities processes.

-

Real-Time Data and ReportingAccess real-time data and reporting to keep a finger on the pulse of your securities transactions. This immediate visibility into your portfolios allows for better monitoring, quicker decision-making, and improved operational transparency, ensuring you stay ahead in a dynamic market environment.

-

Scalable and Flexible SolutionAdjust to evolving market conditions and regulatory changes with a scalable solution that supports various types of securities and operational workflows. The system's flexibility in integration and customisation ensures it meets your specific needs, providing robust performance and adaptability as your business grows.

Product Benefits

Control Cloud Securities

-

Securities reconciliation made easy

Reconciling security positions and transactions is a critical control for all market participants. Buy-Side or Sell-Side. Equity or Derivatives. Control Cloud can adapt to any data and any organisation, large, small, or huge. Built-in workflow and support for complex, long-lived breaks.

-

Any Data. Any Source. Any Format

Wherever your data is coming from, and whatever format it is in Control can consume and understand it. Securities can involve huge datasets, with many hundreds of fields, and Control allows you to utilise all of it for maximum accuracy and efficiency.

-

Our Experts. Your Success

Gresham provide expertise and experience, not just software. Our consultants have deep industry knowledge, and guide on best practice that goes beyond IT to support real business transformation.

-

Deployment options to suit you

Our Cloud, Your Cloud, On-Premise. Managed Service or Self-Sufficient. We work with you to find the optimal solution.

-

Unmatched Matching Power

Control Cloud offers the industry’s most powerful matching engine. Achieve the highest possible match rates, and automatically discover matches that other tools cannot. Let your users focus on the real problems, not the noise.

-

Reconcile fast. Really fast

Control Cloud delivers the fastest matching performance around. Whatever your volumes today, and your plans for the future, Control can handle them.

Related products and services

Control Cloud Intersystems is a product application within the Control Cloud suite of solutions. Explore the other product applications to find the right solution for your business.

Gresham’s Control is easy for our business users to adopt and use. The application’s controls around signoffs, designating reconciliations to different staff, and data collection have made our process more efficient and seamless, and our team more self-sufficient.

Vice President of Operations | Investment Management Firm

Our recent success and go-live with Gresham’s Control Cloud and the prompt yet comprehensive Proof-of-Concept (PoC) meant the decision to expand our use to include Connect Cloud was easy.

Head of Operations Payments | Cash and Securities Provider

Why should any payments firm build this in-house when there is a specialist like Gresham that focuses on it exclusively? Connect Cloud really takes the pain out of message formatting and simplifies the message transformation space.

Product Manager | Global FinTech Company

The solution allows us to focus on more strategic work. We are now able to manage the exceptions rather than all the manual heavy lifting we were having to do before the switch. It meant that we were able to manage a broader estate of recs ourselves without involving IT and tech experts from the previous vendor.

Operations Lead | Global Asset Manager

Project Lead | Global Investment Bank

Explore our client success stories

Insights, made simple

Deep dive into an array of topics and opinions shared by our domain experts. Learn more from articles online or subscribe to our monthly newsletter on LinkedIn.

-1.png)

.png)

.png)

.png)